Loading component...

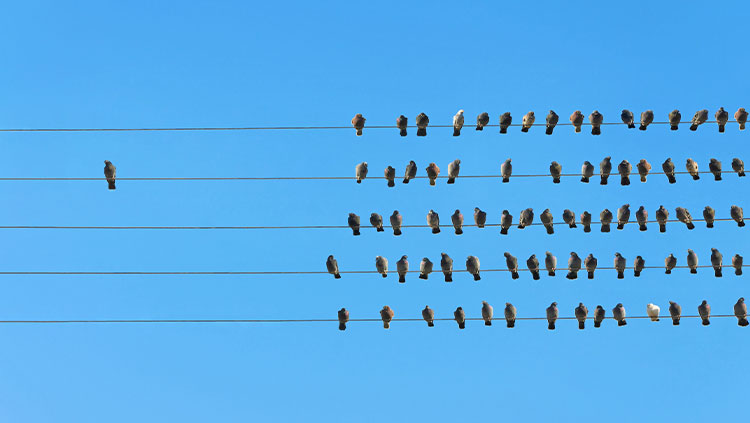

Are you ready to fly solo?

Content Summary

- Career skills

Loading component...

This article was current at the time of publication.

Many accountants dream of starting their own practice, motivated by a desire to be their own boss, generate their own clientele and grow the business.

However, as Montgomery Carey & Associates (MCA) principal Dallas Carey CPA acknowledges, while it is potentially rewarding, running your own practice can be much harder than it looks.

“It’s been a huge learning experience,” Carey says, who left the Warrnambool office of Crowe Horwath in 2017 with colleague Richard Montgomery to start MCA.

“Especially in the infancy stage, you’re thinking of the business 24/7,” he says. “You’re working in the business, as well as on the business.”

Brenton Ellis CPA is director of Melbourne-based accounting, advisory and wealth specialist The Gild Group, which merged with his practice, Network Financial Group, six months ago. Prior to going out on his own, Ellis worked as a tax manager for The Practice and CFO for successful start-up PubCo Group, which operates eight licensed venues across Melbourne and regional Victoria.

“My family has always had small businesses, so it is part of my DNA to run my own show,” Ellis says. “This was something I have always known I would do.”

Are you truly ready?

The key issue is: how do you know if running your own practice is right for you?

Among the first questions to ask, according to Carey, is whether you’re ready for the level of administrative legwork.

“In addition to a new business structure, you may need to organise WorkCover for employees, public liability and professional indemnity insurance, as well as general insurance for the practice,” he says.

Both Carey and Montgomery have completed the Public Practice Certificate, which Carey considers a great tool to understand the minutiae of running an accounting practice.

When you first go out on your own, you may discover areas of expertise in which you are lacking and need to plug the gaps, Carey says.

“Probably the biggest thing I had to upskill in was IT. I’m fairly good with IT generally, but we moved everything to a cloud-based system, so we had to ensure we were secure with regards to data storage.”

Ellis says he is used to hard work, but in the first year of setting up his own practice he was easily working 70 to 80 hours a week. “Your hours will double or triple, so you need to work hard and be prepared for that,” he says.

On the other hand, he maintains that running his own business suits his business-focused personality, which is important when it comes to attracting new clients.

“I can have a natural conversation with someone, and they become a client,” he says. “I have a genuine interest in business and people’s background, so that helps generate work.”

Above all, you need a purpose; a reason to get up every morning and grow the business, which some salaried employees may not have. “For me, it [has been] about improving the way clients and accountants do business through technology,” Ellis says.

He also insists on investing in the right people. “Find the right people and then pay them properly. Having good people around you is critical for success [and] worth every dollar you spend on them.”

Before taking the plunge

A key consideration is whether to build a new practice from scratch or try to retain existing clients. Carey and Montgomery were able to keep their client base when they amicably left their previous firm, but not all employers allow it.

“It is a case-by-case basis in terms of what your contract states and obviously it needs to be negotiated with your employer,” Carey says. “Ask yourself: if you are not able to take clients with you, will you be prepared to start from scratch?”

He emphasises that you need a “plan A, plan B, and plan C because not everything goes how you would like”.

“We didn’t know exactly what was going to happen but were prepared to go out on our own and start fresh if need be. Of course, there are no guarantees clients will automatically come with you, but we felt we would have success in this area and that proved to be the case.”

An alternative option

You may also wish to buy a business to avoid the headaches of establishing a practice from the ground up.

“It’s great to explore it, but just make sure you research it extensively and do your due diligence,” Carey says. “It’s the clients who keep the practice going, so you want to make sure they’re the right fit for you.” Having a business partner allowed Carey to “bounce a lot of ideas off someone I could trust”.

Ellis agrees and says part of the reason he merged his business with another – in addition to facilitating further growth – was to gain a sounding board via a new business partner, director Paul Luczak CPA.

“Economies of scale are a big advantage, too, as is being able to divide responsibilities based on where your individual strengths lie,” Ellis says.

How to prepare to launch your own practice: tips from Dallas Carey CPA

- Sketch out what you want the practice to look like and its ideal client base.

- Conduct all due diligence and plenty of research about what is required of you, including accessing CPA Australia’s online resources on starting your practice.

- Expect to work much harder than you do now.

- Consider taking on a trusted business partner to share the workload.

Loading component...

Discover more

Resilient teams: What great leaders do differently

2 June 2025 | Explore expert-backed strategies ON building resilience for when your teams are under pressure. From open communication to workplace wellbeing, learn how leaders can support teams during peak business periods such as EOFY.

- Career skills

Published on6 min read timeHow microcultures can transform your workplace

2 June 2025 | Microcultures are reshaping modern workplaces. See how they foster team alignment, boost agility and bring values to life in a diverse, high-performing organisation.

- Career skills

7 min listening timePublished onIs 'collaboration overload’ hindering your productivity?

1 April 2025 | Collaboration may be a workplace ideal, but new research reveals its downsides. Excessive meetings and emails can lead to 'collaboration overload', decreasing productivity, increasing burnout and staff turnover. Here's what you need to know.

- Career skills

Published on6 min read timeHow to automate report building in Excel

1 March 2024 | Using dynamic array, these practical tips will help you build automated reports

- Career skills

Published on12 min read timeWhat is workplace trust in the digital age?

19 September 2023 | Rachel Botsman unpacks how trust impacts today’s business leaders.

- Career skills

Published on26 min read timeCareer Skills

Insights for accounting and finance professionals on productivity and workplace issues

- Career skills

Published on