Loading component...

Making the most of your CPA Program resources

When approaching your studies in the CPA Program, it’s important to understand the range of support options available to help you succeed and study your way, on your terms. The core of your learning is the study guide, which contains all the examinable material for the CPA Program and should be considered your primary reference throughout the semester. Other resources, such as guided learning, professional tuition, webinars and quizzes are designed to complement the study guide and support different learning styles.

Digital study guides

When you enrol, you'll gain immediate access to a PDF version of your study guide in My Online Learning, so you can start learning straight away. When semester begins, you'll also gain access to a study guide eBook where you can highlight, take notes and flag sections – just like a hardcopy version.*

Excluding Singapore Taxation, which has a printed study guide only. See below for details about your hard copy study guide.

Hardcopy study guides

Your hardcopy study guide will be sent to the preferred mailing address you nominated when you enrolled.

Before enrolling, make sure your mailing address in your member profile is up to date, as this is where your study guide will be sent. You can change your mailing address up until the closing date for changes.

How to track the delivery of your study guide

If you'd like to track the progress of your study guide delivery, please refer to the consignment reference in My CPA Program alongside the courier being used for dispatch.

The couriers used by CPA Australia are:

| Courier | Tracking facility |

|---|---|

| Australia Post | Australia Post website |

| Australia Post - PO BOX addresses (International and Domestic) | No tracking facility available |

| DHL | DHL website |

| StarTrack Express | StarTrack website |

| Singapore Post | Singpost website |

Please wait until the expected delivery date has passed before contacting CPA Australia about your study guide delivery.

If you require replacement materials, contact us. Charges may apply.

Nominating your mailing address

Learning resources to keep you focused

My Online Learning

This platform houses all of your CPA Program learning materials and study resources

Guided Learning

We’ve partnered with KnowledgEquity to deliver a suite of resources to guide your CPA Program studies

Professional tuition

We work with approved providers to deliver face-to-face tuition for candidates who thrive on direct teacher contact

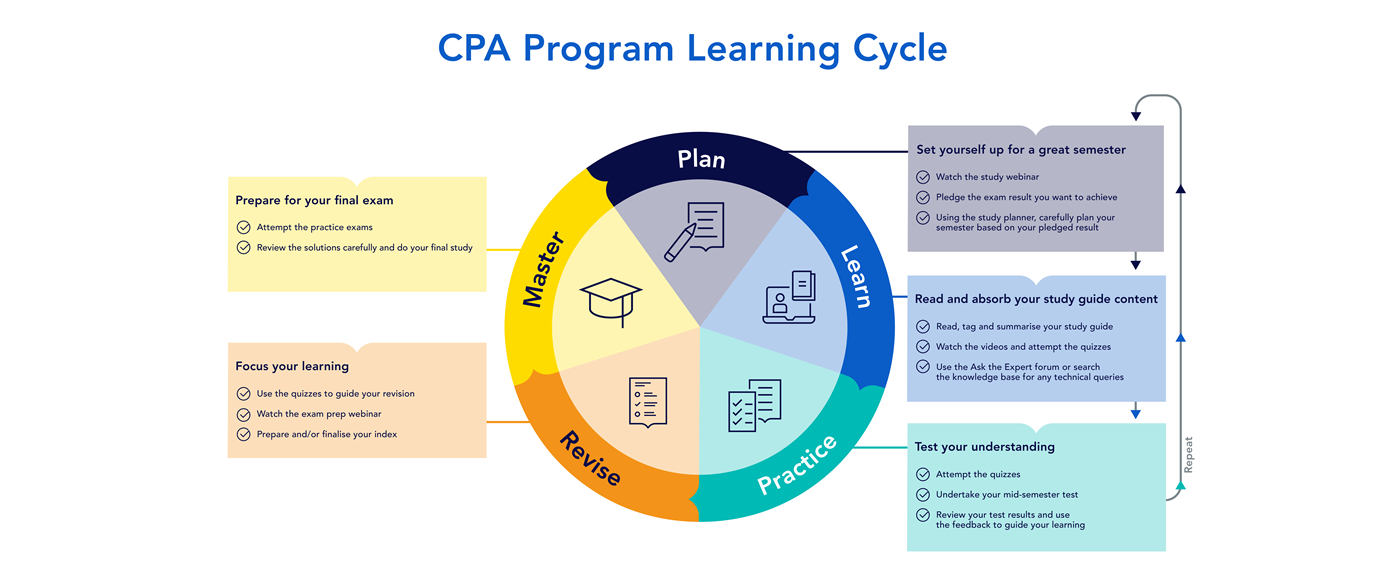

A five-step approach to study

How to use your Guided Learning resources

More support options

Online resources

If you’re having difficulty with a particular subject or topic, our qualified Library staff can help you to source relevant resources

Member access onlyFace-to-face tuition

We've partnered with professional providers to offer direct contact tuition for our students

Contact us

Remember, we’re here to help, you can contact us anytime or visit your local Division office